Industry Report

2022 IAA Industry Report

Mixed Year Sees Growth Despite War, Inflation and Other Challenges

Published April 20, 2023 - Written by IAA, Inc.

Summary

The much-anticipated IAA-exclusive 2022 IAA Industry Report is filled with data and insights on the U.S. economy, the automotive and salvage industries, the EV market, metals, used-car prices, the Canadian market, and much more. With reverberations from war, high inflation, an ongoing chip shortage, and high crude oil and natural gas prices, the economy, and the salvage and automotive industries, saw mixed results in 2022.

Economic Summary

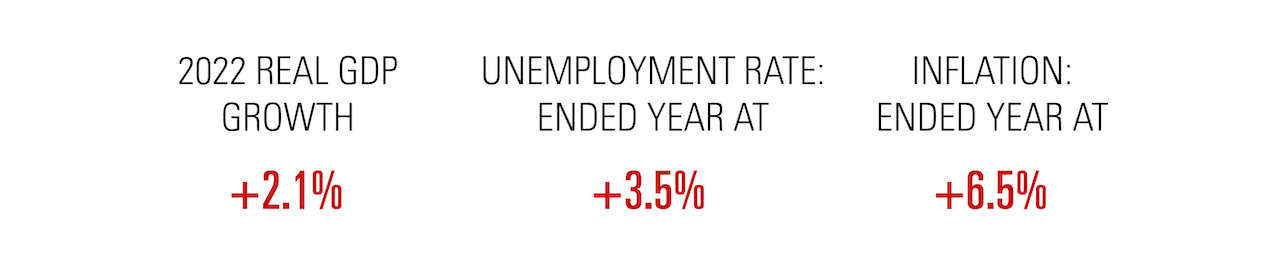

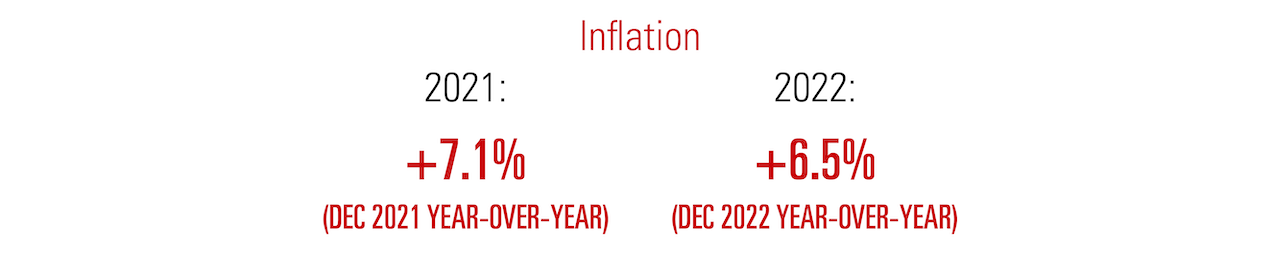

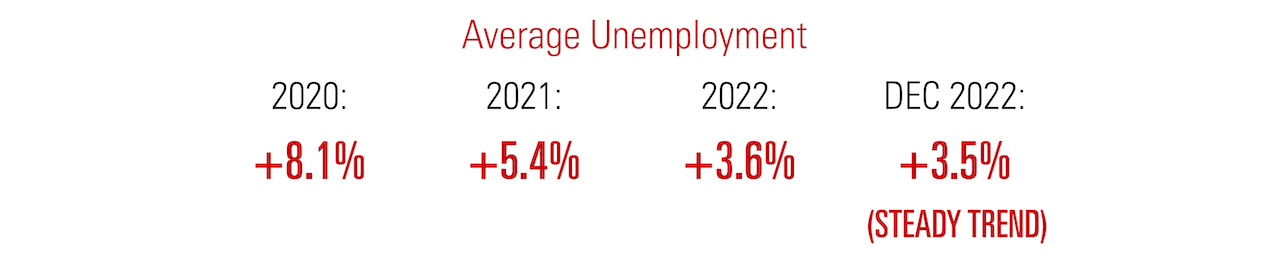

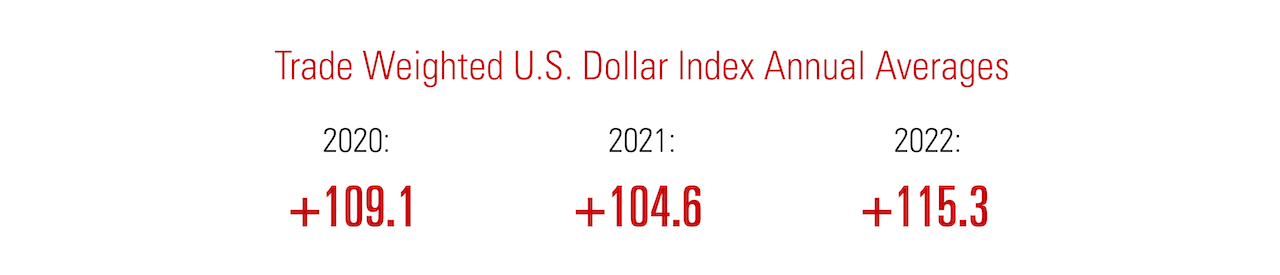

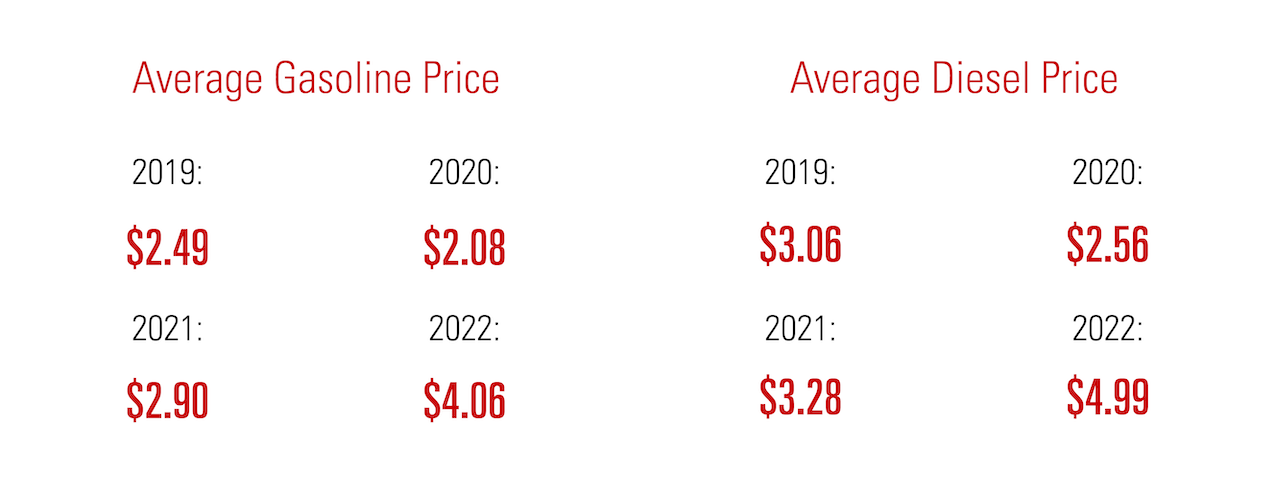

Although the U.S. economy got off to a slow start in 2022, it grew throughout the year. That growth has been ongoing since GDP returned to pre-pandemic levels in 2021, increasing 2.1% last year.1 Year-over-year inflation fell slightly, from 7.1% to 6.5%, driven by several interest rate increases by the Federal Reserve to dampen inflationary heat and ease supply-side pressures.2 However, with high monthly inflation volatility throughout 2022, prices continued to rise in prominent everyday goods, such as food, energy, rent and transportation. The labor market remained steady, ending at 3.5% unemployment in December3, with the addition of 4.5 million jobs for the year.4 Pressure on wage growth—instigated by pandemic-related labor shortages—peaked in 2022, reaching a high of 4.6% before beginning to decrease at year‘s end.5 The value of the U.S. dollar also strengthened during the year, rising 10.7% relative to other major foreign currencies.6 However, last year gas and diesel prices rose by 40% and 52%, respectively.7 This phenomenon was heavily influenced by the Russian invasion of Ukraine, as Russia remains a major global source of crude oil and natural gas.8

AUTOMOTIVE SUMMARY

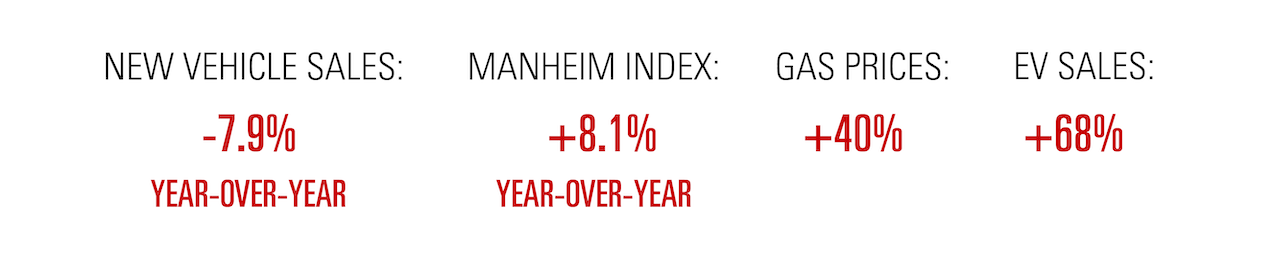

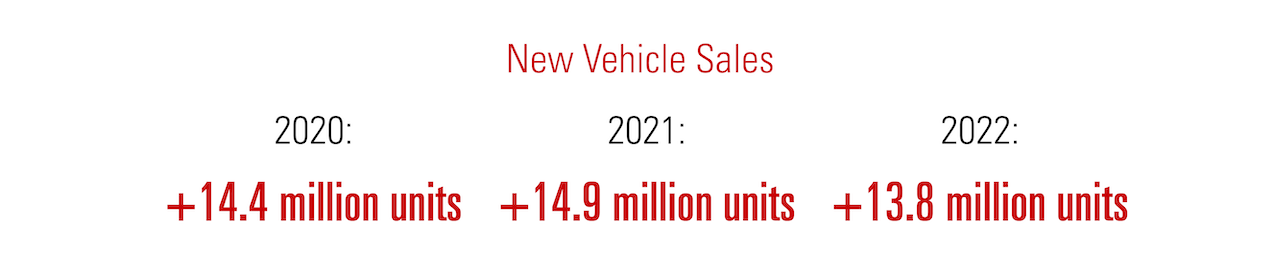

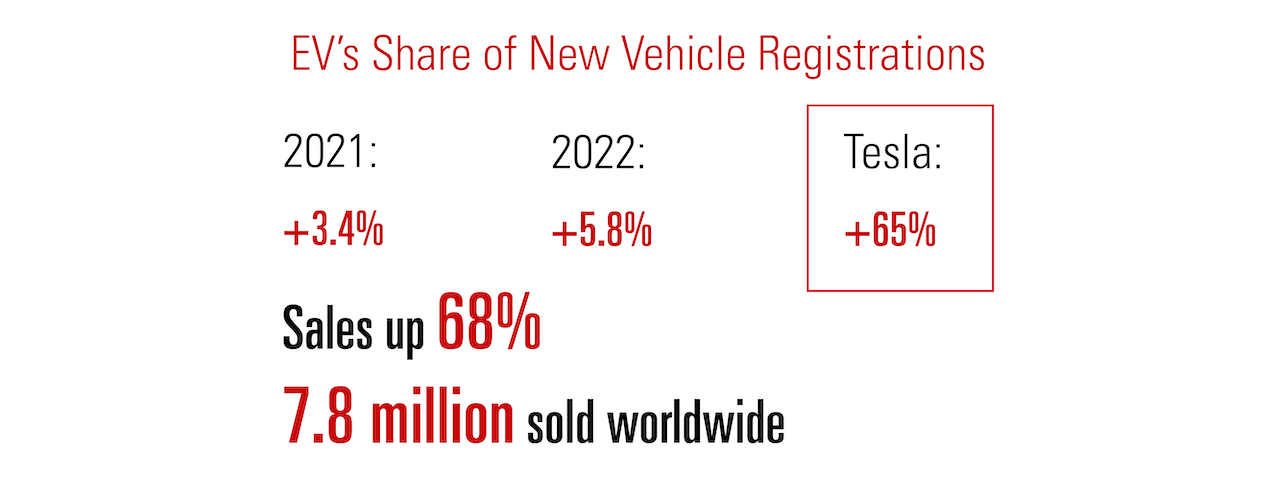

The automotive industry continued to face challenges caused by the semiconductor microchip shortage.9 The shortage cut new vehicle inventory levels, dropping sales 7.9% year-over-year.10 The scarcity of new vehicles caused a natural increase in demand for used vehicles, which saw an 8.1% jump in the Manheim Used Vehicle Index from 2021’s full-year average to 2022’s.11 However, the index peaked in January 2022 and declined through December 2022 by 14.8%.12 Electric vehicle (EV) sales continued to rise in 2022, with 7.8 million sales, a 68% increase from 2021.13 EV’s market share has been continuously rising, hitting an estimated 10% globally.14

SALVAGE SUMMARY

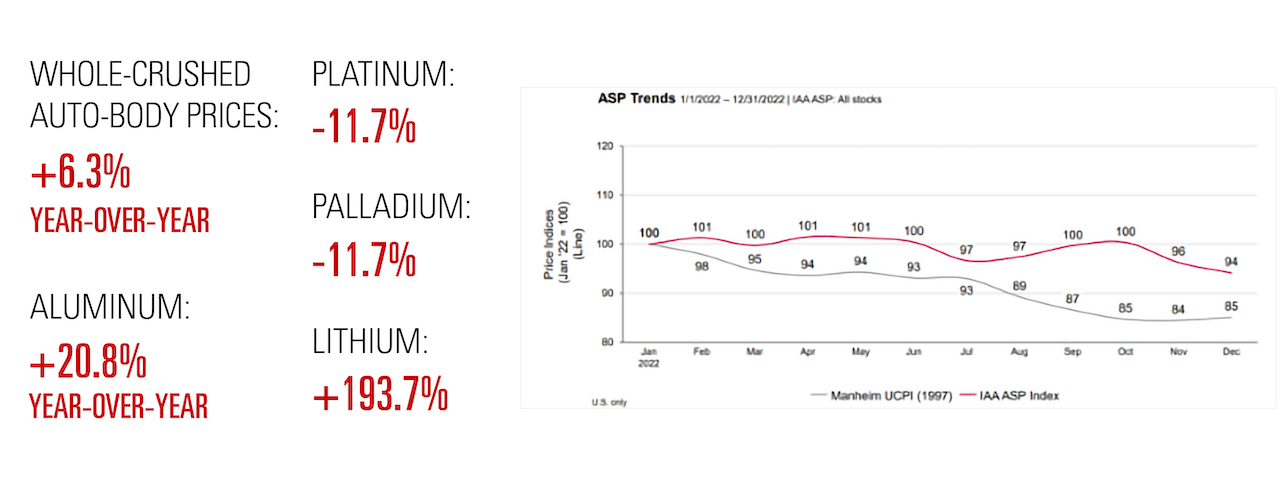

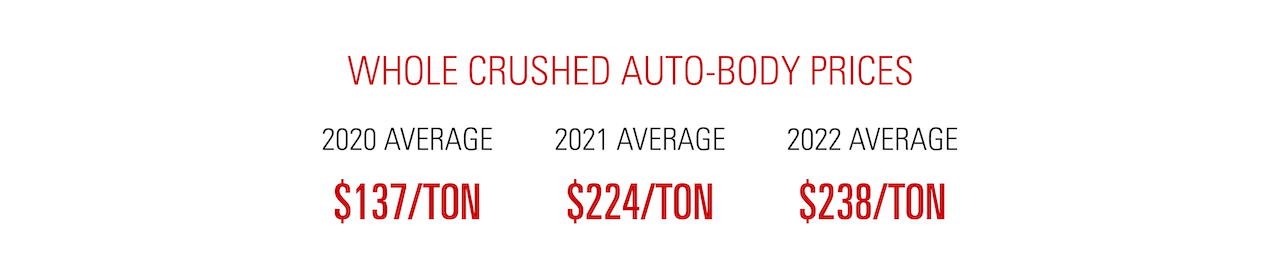

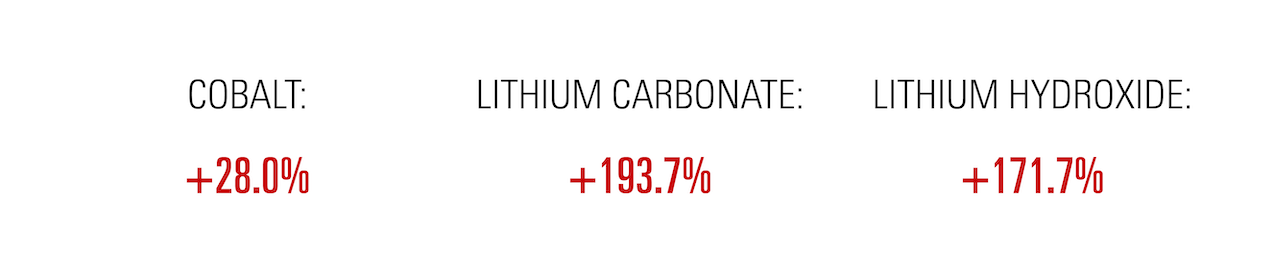

Continued demand for scrap metal kept whole crushed auto-body prices up in 2022, increasing 6.3% from 2021.15 From a metals perspective, platinum prices decreased 11.7% year-over-year primarily due to significant global economic turbulence caused by inflation and other factors, including fragile re-established supply chains and lingering chip shortages.16 In September 2022, platinum sank to its lowest point in nearly two years.17 However, this low was short-lived as platinum prices rebounded when automotive demand began to recover during the second half of 2022 after two years of pandemic disruptions.18 Palladium’s price fell 11.7% from 2021, though briefly hit an all-time high in March 2022 following the invasion of Ukraine by Russia, platinum’s biggest exporter.19 Prices quickly dropped as the year went on and stabilized in late 2022 on lower automotive sector demand.20 Prices rose for metals commonly used in the production of EV batteries. Lithium, for example, jumped 193.7% for the year.21 IAA has observed that selling prices have remained stable and continued to outperform the used retail market.22

Section One

U.S. Economy

2022: U.S. ECONOMIC READJUSTMENT

The economy recovered to pre-pandemic U.S. GDP levels in 2021, and throughout 2022 it continued to strengthen, although at a slower pace than the previous year. GDP grew 2.1% in 2022, totaling approximately $25.46 trillion for the year.23 Increases in consumer and government spending, exports, private inventory adjustments, and nonresidential fixed investments were the primary drivers of growth.24 Consumer spending continued to favor services over goods, as it did in 2021 and before the pandemic in 2020.

In Q1 2022, GDP fell 1.6% from the previous quarter.25 This slow start continued into Q2 2022, as GDP fell 0.6% from Q1.26 However, GDP gained traction in Q3 and Q4, with 3.2% and 2.9% growth, respectively.27 Although these numbers are relatively small, 2021 was a strong recovery year following the 2020 pandemic, with 5.7% annual GDP growth.28 Thus, the 2.1% GDP increase in 2022 was a return to the ideal range of annual GDP growth of between 2-3%.29 This could have a positive impact on the economy, given that overheated production is a driver of higher inflation and prices.30

INFLATION STILL HOT

After 2021 experienced the highest year-over-year inflation rate in 40 years, 2022 continued to see overheated levels. Rates fell slightly from that record-breaking annual rate of 7.1% to 6.5%.31 While inflation rose steadily in 2021, it was volatile in 2022, peaking at 9.1% in June before settling to 6.5% in December.32

Although the Federal Reserve raised the federal funds rate seven times during the year—from 0% to 4.5%—to combat high inflation, prices continued rising in key staples.33 From December 2021 to December 2022, food prices increased 10.4%, energy prices rose 7.3%, and rent for primary residences jumped 8.3%.34 A major driver behind the uptick in food and energy prices was the war in Ukraine, as Russia and Ukraine are global sources of grain, crude oil and natural gas.35 Since Russia and its ally Belarus account for a large portion of the global fertilizer supply, the war negatively impacted global food production.36

The automotive industry, motor vehicle repair and maintenance sectors had a 13% increase in year-over-year inflation, and motor vehicle insurance rose 14.2%.37 While used vehicle prices have steadily decreased since a 2021 spike, new vehicle prices hit record highs in 2022.38 Airline fares also rose by 28.5%,39 likely driven by the continuing recovery of travel following the 2020 pandemic and the 106.1% year-over-year increase in jet fuel costs for U.S. carriers.40

LABOR MARKET REMAINS RESILIENT

THE UNEMPLOYMENT RATE BEGAN THE YEAR AT 4%, AND GRADUALLY DECREASED TO 3.5% BY DECEMBER.41

The number of long-term unemployed persons—out of work for more than 27 weeks—dropped almost 50% between December 2021 and December 2022, from 2 million to 1.1 million.42 This may indicate movement back to work by those who were unable to work or took time off during the pandemic. The labor force participation rate ended the year at 62.3%, still 1% below pre-pandemic levels.43 The demand for labor remained strong, especially since over the last three years roughly 2 million people retired earlier than anticipated and those working over age 55 declined to 38.8% in December.44 Additionally, 4.5 million jobs were added to the economy in 2022, particularly in leisure and hospitality, health care and social assistance, and professional and business services.45 This was still 2.2 million fewer jobs than the number added in 2021, providing another indication that the economy was cooling down.46

WAGE GROWTH PEAKS

Wages increased 4.6% in 2022, which was slightly higher than the 3.7% average annual growth over the previous three years.47 This was likely due to continued demand for higher wages by workers post-pandemic, as well as fluctuating labor shortages in various industries. According to Indeed Wage Tracker, overall wage growth increased across all categories in 2022, peaking at 12.3% for the low-wage category, 8.4% for middle-wage, and 7.7% for high-wage.48 However, toward the end of the year wages began decreasing. According to Nick Bunker, Indeed Director of Economic Research, “The deceleration is broad-based, with wages in 82% of job sectors lower in November than six months earlier.”49 The largest drop occurred in the low-wage category, that includes jobs in food service, childcare, and low-level retail.50

RISE OF THE DOLLAR

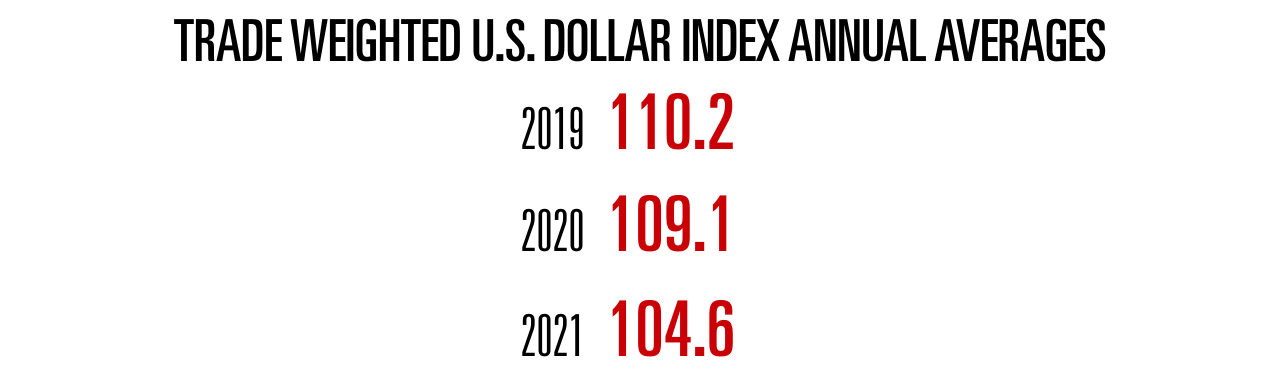

THE WEIGHTED INDEX OF THE U.S. DOLLAR RELATIVE TO THE CURRENCIES OF MAJOR TRADING PARTNERS ROSE 10.7% IN 2022, FROM AN ANNUAL AVERAGE OF 104.6 IN 2021 TO 115.3.51

Over the course of 2022, the U.S. dollar gained strength, resulting in higher purchasing power. Beginning at a low point of 94.6 in January, then skyrocketing to a 20-year high of 114 in September, the U.S. dollar exhibited strong performance overall.52 The Federal Reserve’s implementation of higher interest rates throughout the year to combat inflation could also have contributed to this strength, as higher interest rates encourage foreign investment and increase demand for U.S. dollars to purchase American exports.53

GAS PRICE INCREASE IMPACTS VEHICLE MILES TRAVELED IN 2022

As gas prices soared to record levels in 2022, reaching over $4 per gallon by year-end, consumers were forced to adjust their driving habits.54 The sharp increase in gas prices, driven by the rise in oil prices after Russia’s invasion of Ukraine, resulted in a 40% increase in gas prices and a 52% increase in diesel prices.55 With the cost of fuel significantly impacting household budgets, many drivers chose to cut back on vehicle miles traveled, particularly during the summer months when gasoline demand typically rises. Gasoline demand declined as people avoided traveling because of its high cost. Soon prices followed suit and began dropping later in the year.

Section Two

AUTOMOTIVE INDUSTRY

SUPPLY CHAIN CHALLENGES HIT NEW VEHICLE SALES

After an increase in new vehicle sales from 2020 to 2021, sales dropped to 13.8 million units in 2022.56 A 4% decrease brought new vehicle sales to their lowest level since 2011.57 New vehicle sales virtually stopped during the COVID-19 pandemic when supply chain problems—created by microchip production issues—caused a decline in vehicle production. Original estimates that the shortage would ease by mid-2022 were derailed when the Russia-Ukraine War exacerbated challenges in the microchip market.58 Ukraine supplies nearly 60% of the world’s neon, which is a crucial element in microchip production.59 Automakers had to cut production down based on this shortage, creating lower new vehicle inventory levels.60 While new vehicle sales increased from November to December, production shortages leading to lower inventory and increased prices played a key role in the sales decrease.

RECORD HIGH USED VEHICLE PRICES SLOWLY DECLINE

In 2022, used vehicle wholesale prices hit a record high annual average of 235.5 on the Manheim Used Vehicle Index.61 While the index was up 8.1% from 2021‘s full-year average to 2022‘s, it actually peaked in January 2022 and declined 14.8% the rest of the year.62 As the microchip shortage continued to affect new vehicle inventory levels, demand for used vehicles reached an all-time high of $31,095 in April 2022.63 By December 2022, the average price had fallen to $29,533.64 One reason for the price drop was higher interest rates, which made cars more expensive to purchase. This created an affordability issue for many buyers, decreasing demand. As new vehicle inventory began to stabilize, used vehicles prices began to decrease. Tyson Jominiy, Vice President of Data and Analytics at J.D. Power, expects this trend to continue.65 “Buyers can expect to see lower prices [in 2023].”66 In 2022, the chip shortage eased slightly as the drop in electronics demand gave the automotive industry better access to chips.67 Therefore, prices in 2022 were still high; however, they began to decrease. This was positive news for potential used car buyers.68

DEMAND FOR TECHNICIANS LEADS TO INCREASED REPAIR CONSTRAINTS

A severe demand for auto repair technicians in 2022, caused by a high turnover rate, a long-term industry labor shortage and a high rate of retirements among older technicians, lead to increasing assign cycle times. The annual demand for new technicians in 2022 was more than 35,000, while there were only 4,500 graduates from post-secondary collision programs. Additionally, today’s more complex vehicles are requiring new skillsets, and many shops cannot repair as many vehicles as quickly as they could before the pandemic. All of these issues are adding up to significant repair constraints, rising wages and higher repair costs.69 IAA saw an average increase of 16.3%, or three days, in loss to assign YoY statistics, which could be attributed to auto tech shortages and reparability constraints.70

Section Three

Economic Indicators of Automotive Salvage

HIGH DEMAND FOR AUTOMOTIVE SCRAP, THOUGH PRICES REMAIN STEADY

Continued high demand for scrap metal kept whole crushed auto-body prices high in 2022. The year-over- year price increase was less extreme compared to the previous year, indicating that prices were steadier in 2022. Consumer demand for products in the electronics, automotive and construction sectors, along with increased awareness of the benefits of recycling metals, helped increase demand for recycled scrap metal.71 Higher copper and steel prices encouraged producers to go after recycled scrap, as recycling costs less than mining ore.72 However, copper and steel endured a more challenging 2022. Following all-time high prices in 2021, copper continued an upward trend in the first half of the year, but headed downward in the second half.73 China, the world’s top copper consumer, imposed lockdown measures to contain the coronavirus in Q1, causing copper prices to fall.74 During Q4, copper prices began to increase slowly.75 Supply disruptions in top-producing countries Peru and Chile, and the continued COVID-19 measures in China, put downward pressure on the copper market.76 Steel prices declined throughout 2022, as the market was volatile due to supply chain issues and geopolitical events.77 As a result, crushed auto-body prices trended downward during the second half of the year. Whole crushed auto-body prices were up 6.3% from the previous year, but fell from $262 per ton in May to $200 in December.78

ALUMINUM, PLATINUM AND PALLADIUM

Aluminum prices increased in early 2022, but then saw a great deal of volatility. Russia’s invasion of Ukraine impacted aluminum prices in 2022 by forcing three aluminum manufacturing facilities—which can produce 2.5 million tons annually—to shut down.79 With less supply, all-time high aluminum prices were seen in the middle of 2022.80 In Q3, Aluminum prices began to fall as a contracting U.S. economy raised fears of a possible recession.81 With an embargo on Russian oil, the energy crisis worsened, further impacting aluminum production and causing prices to fall and inventory to drop.82 Despite all of the fluctuation, the price of aluminum still rose 21.2% for the year, averaging $1.37/lbs.83 Platinum prices dropped 11.7% from 2021, primarily due to the global economic turbulence caused by inflation.84 In 2022, platinum hit its lowest price in nearly two years.85 However, this did not last long as increased automotive demand helped push platinum prices back up.86 The end of 2022 saw prices mirroring those at the end of 2021. Palladium fell by 11.7% overall in 2022 after initially spiking to an all-time high at the beginning of the year due to Russia’s invasion of Ukraine.87 Despite the record high, palladium prices quickly dropped and stabilized later in 2022 thanks to lower automotive sector demand.88

Section Four

ELECTRIC VEHICLES

EV MARKET STRENGTHENS

Approximately 7.8 million electric vehicles were sold worldwide in 2022, a 68% increase over the previous year.89 The market share of electric vehicles in the U.S. jumped from 3.4% to 5.8% of new vehicle registrations.90 Preliminary research indicates EVs seized roughly 10% of the global market share in 2022, a strong uptick from the modest 4.1% in 2020 and 8.6% in 2021.91 While Tesla dominates new EV registrations with 65% EV market share, this has steadily decreased from its 79% in 2020 and 72% in 2021.92 New manufacturers have entered the EV space and continue to add new models to the mix.93 However, Tesla is the big player in the luxury EV market with an 85% share.94 This indicates other manufacturers have yet to fully break into the luxury EV space.95 Additionally, increased used vehicle prices, higher fuel prices, tax credits and rebates for EV purchases, and the push toward improved infrastructure for EVs are key drivers increasing EV market share. This will likely continue into 2023 under current market conditions.

EV METALS

Cobalt prices rallied in the first couple of months of 2022 on the heels of steady, strong demand for electric vehicles.96 During the year, however, the price rally paused and then stabilized. In Q1, persistent tight conditions and strong demand continued in the battery market.97 According to S&P Global Market Intelligence Senior Analyst Alice Yu, “the Russia/Ukraine conflict further tightened cobalt availability, which has been under pressure from persistent logistical challenges since May 2021.”98 European metal prices started the year at $32 but rose due to constrained conditions and the war in Ukraine.99 By the end of March, European prices were $40.100 In Q2, the price rally paused due to China’s COVID-19 restrictions’ impact on battery supply chains.101 In Q3, cobalt prices were stabilized by a decrease in consumer electronic demand.102 In Q4, demand remained high thanks to a strong EV sector.103 Average cobalt cathode prices per pound increased 28% year-over-year.104 As for lithium, the leading battery type for EVs, demand for the metal continued to grow significantly in 2022. Lithium carbonate prices per metric ton increased 193.7% year over year.105 The lithium hydroxide Benchmark Mineral Intelligence price index increased 171.7% year over year.106 Record high lithium prices persisted, fueled by a mismatch between short supply and high demand. According to metals pricing director Scott Yarham, “despite COVID-19, EV sales accelerated globally much faster than expected in the past year and went into hyperdrive.107 As a result, the demand for lithium, which is essential for EV batteries, is growing much faster than supply, creating a market disconnect.”108

Section Five

LOOKING FORWARD

ECONOMY

The outlook for 2023 has both positive and negative implications for the economy. According to Marko Kolanovic, Chief Global Market Strategist at J.P. Morgan, “Central banks will likely be forced to pivot and signal cutting interest rates sometime [in 2023].”109 This ultimately should result in the recovery of asset prices and the economy before 2024, which is a positive outcome.110 However, with decreasing interest rates may come various negative effects. For interest rates to drop Kolanovic believes “we will need to see a combination of economic weakness, increased unemployment, market volatility, a decline in risky asset levels, and a drop in inflation.”111 These financial conditions are expected to continue to tighten in 2023, and monetary policy will add further restrictions.112 In 2023, according to J.P. Morgan, unemployment may rise to 5%.113 These factors are raising the specter of a possible recession. According to the World Economic Forum, due to the likelihood of Monetary Policy tightening in the economy, two-thirds of chief economists believe a global recession is likely this year.114

GEOPOLITICAL UNCERTAINTY

Going into 2023, there was significant geopolitical uncertainty due to the Russia- Ukraine conflict. The war has led to major food and energy supply chain issues. Kristalina Geogrgieva, head of the International Monetary Fund, spoke about the predicted outcome for the U.S. economy in 2023. Geogrgieva said that Congress potentially not raising the debt ceiling is a big economic issue that could devastate many countries whose economies depend on the U.S. dollar.115 When discussing potential economic growth, she said that the U.S. is “likely to see a year of slower growth with relatively high interest rates.”116 With an economic slowdown this year, Geogrgieva believes the U.S. economy will narrowly avoid a recession.117 Following this thought, the U.S. is expected to see a slightly weaker labor market with the perception that inflation will shrink by 2024.118 Inflation has been a global issue impacting many developed economies, but is likely to drop from the 8.8% seen in 2022 to 6.6% in 2023.119

AUTOMOTIVE INDUSTRY

New vehicle inventory levels have started to increase, but there are still potential issues that may cause the automotive industry to continue to struggle in 2023. While increased inventory has coincided with a downward trend in used vehicle prices, there are still improvements to be made in both markets. Auto loan interest rates have been on the rise, another potential damper on vehicle sales.120 Guidehouse Insights analyst Sam Abuelsamid predicts that “car buyers will be paying more for new vehicles” because low inventory is creating “reduced or nonexistent deals.’’121 Although used vehicle prices have been dropping, values are still historically high after the pandemic caused an 88% increase in the Manheim Used Vehicle Value Index.122 Andrew Smoke, Chief Economist at Cox Automotive, believes that in 2023 demand should start to stabilize, which will lead to “more affordable buying options.”123

METALS

In 2022, metals continued to be a hot commodity. As EV sales increased, so did the demand for cobalt and lithium, which are essential materials for battery production.124 Prices for both metals increased year-over-year. Lithium saw an annual price jump of 193.7%.125 The per metric ton price went from $12,600 in 2021 to $37,000 in 2022.126 In addition, demand for other materials used to make batteries, including nickel and lead, remained high.127 Steel, another important material for the production of new vehicles, had long-term price declines throughout 2022 as geopolitical events and supply chain issues created a volatile market.128 As for aluminum, the embargo on Russian oil placed more strain on the energy market and further impacted aluminum production, causing the all-time high aluminum prices to fall and inventory to drop.129 According to Fastmarkets’ analysts Boris Mikanikrezai, James Moore, Andy Cole, Andy Farida, and Yang Cao, “the effects of the re-opening of China, the economic recovery of the United States, and a less hawkish position from the U.S. Federal Reserve Bank (the Fed) are predicted to become evident in the third or fourth quarter of 2023, and lead to an overall improvement in the base metals market by the end of the year.”130

IAA OUTLOOK

The used car market is expected to experience a decrease in actual cash value, but IAA’s actual sale price is predicted to outperform the overall market. Additionally, gross return percentages are likely to either increase or remain stable. Overall, these trends suggest that IAA may be well-positioned to weather the anticipated pullback in the used car market.131

Section Six

CANADIAN COMMENTARY

ECONOMY CONTINUES TO SLOWLY RISE

Canada’s economy experienced significant inflationary pressure last year, peaking at 8.1% year-over-year inflation in June and ending the year at 6.3%.132 Similar to the U.S., prices continued to rise in many prominent everyday goods, such as food, rent and energy.133 Gas prices rose as a result of uncertainty in the crude oil market caused by the Russian invasion of Ukraine.134 But despite volatility and global economic issues, the Canadian economy prevailed with GDP rising 3.9% from 2021.135 This growth was due to a noticeable increase in household savings, business investment, high commodity prices, and a pent-up demand for services.136 Unemployment began the year at 6.5% and dropped to 5% by year end, falling 29.1% from 2021.137

Looking ahead, even though Canadian unemployment fell in 2022, overall demand still exceeds the supply the economy is currently able to provide, and the need for labor continues into 2023 as businesses struggle to find enough workers.138 The Bank of Canada increased the interest rate by 350 basis points last year, from 0.5% in March to 4.25% by December, to combat overheated inflation and demand. How much the interest rate continues to rise in 2023 will likely depend on how quickly supply is able to catch up to demand.139 Therefore, in the coming months the Canadian economy may slow down in response to the restrictive monetary policy. However, according to the Bank, “Lower energy prices, improvements in global supply conditions, and the effects of higher interest rates on demand are expected to bring CPI inflation down to around 3% in the middle of [2023] and back to the 2% target in 2024.”140

According to the Business Development Bank of Canada, this downturn could lead consumers to become more apprehensive toward spending in the short run, decreasing business sales and Canadian GDP.141 An increase in unemployment would not be unusual, but since there is still high demand for labor, a contraction in the market is “more likely to translate into fewer hours worked and less demand for staff.”142 Because this economic slowdown is driven by policy rather than external shocks, Canada is in a better position to control its economic performance in 2023. For this reason, while a recession is still possible, at this time it is more likely that economic growth will merely take a backseat as the economy rebalances.143

Section Seven

UNITED KINGDOM COMMENTARY

UNITED KINGDOM’S ECONOMIC FUTURE REMAINS UNCERTAIN

At the start of 2022, the United Kingdom’s economy had grown beyond its pre-pandemic size and was continuing to expand as unemployment rates fell below 4%.144 Overall, the economy improved slightly from 2021 to 2022 as GDP grew by about 1%.145 The cost of living, however, rapidly increased during the year. Inflation finished the year at 10.5%, a massive 91.8% increase from December 2021.146 Part of the spike was attributed to rising gas prices. The country typically uses more gas than its neighbors as it has less available renewable energy.147 In late 2022, the government introduced the Energy Price Guarantee to stop rising inflation.148 The measure caps the unit cost of energy, which the government projects can save the average household €900 in winter.149

Looking ahead, the UK’s economic growth is expected to slow due to the Russia-Ukraine conflict, according to PricewaterhouseCoopers(PwC).150 This conflict is predicted to impact the economy through higher commodity prices, the disruption of supplies, issues with financial uncertainty, and defaults in trade and investment.151 Due to these predicted economic changes, the Confederation of British Industry (CBI) expects the UK’s economy to shrink 0.4% in 2023.152 Inflation may drop, though it will likely be gradual and remain “significantly above the Bank of England’s 2% target.”153 With regard to the future of the country’s economy, the CBI predicts a possible recession, stating that “while it’s some consolation that the upcoming recession will be shallow, its concerning longer- term weakness in productivity and business investment appears to be bedding in.”154 The CBI hopes for government intervention to avoid stagnant productivity and business investment.155

FORWARD-LOOKING STATEMENTS:

IAA Holdings, LLC (as successor to IAA, Inc.) (“IAA”), a leading global digital marketplace connecting vehicle buyers and sellers, is now a subsidiary of Ritchie Bros. Auctioneers Incorporated (NYSE: RBA) (TSX: RBA). This 2022 IAA Industry Report (the “Report”) includes forward-looking information within the meaning of Canadian securities legislation and forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Forward-looking statements may include statements relating to future events and anticipated results of operations, business strategies, the expected timing and associated benefits with respect to the matters, products and services discussed in the Report on our business and plans regarding our growth strategies, and to our customers and company generally, and other aspects of RBA’s or IAA’s respective businesses, operations, financial condition or operating results and other statements that are not historical facts. Words such as “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” “could,” “can,” “intends,” “target,” “goal,” “projects,” “contemplates,” “believes,” “predicts,” “potential,” “continue,” “foresees,” “forecasts,” “estimates,” “opportunity” and similar expressions identify forward- looking statements.

It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of RBA’s common shares. Therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. While RBA’s management believe the assumptions underlying the forward-looking statements are reasonable, these forward-looking statements involve certain risks and uncertainties, many of which are beyond RBA’s control, that could cause actual results to differ materially from those indicated in such forward-looking statements, including but not limited to: the effects of the business combination of RBA and IAA, including the combined company’s future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the merger; the diversion of management time on transaction-related issues; the response of competitors to the merger; the ultimate difficulty, timing, cost and results of integrating the operations of RBA and IAA; the fact that operating costs and business disruption may be greater than expected following the consummation of the merger; the effect of the consummation of the merger on the trading price of RBA’s common shares; the ability of RBA to retain and hire key personnel and employees; the significant costs associated with the merger; the outcome of any legal proceedings that could be instituted against RBA; the ability of the combined company to realize anticipated synergies in the amount, manner or timeframe expected or at all; the failure of the combined company to realize potential revenue, EBITDA, growth, operational enhancement, expansion or other value creation opportunities from the sources or in the amount, manner or timeframe expected or at all; the failure of the trading multiple of the combined company to normalize or re-rate and other fluctuations in such trading multiple; changes in capital markets and the ability of the combined company to generate cash flow and/or finance operations in the manner expected or to de-lever in the timeframe expected; the failure of RBA or the combined company to meet financial forecasts and/or KPI targets; legislative, regulatory and economic developments affecting the business of RBA; general economic and market developments and conditions; the evolving legal, regulatory and tax regimes under which RBA operates; unpredictability and severity of catastrophic events, including, but not limited to, pandemics, acts of terrorism or outbreak of war or hostilities, as well as RBA’s response to any of the aforementioned factors. Other risks that could cause actual results to differ materially from those described in the forward-looking statements are included in RBA’s periodic reports and other filings with the Securities and Exchange Commission (“SEC”) and/or applicable Canadian securities regulatory authorities, including the risk factors identified under Item 1A “Risk Factors” and the section titled “Summary of Risk Factors” in RBA’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and IAA’s periodic reports and other filings with the SEC, including the risk factors identified under Item 1A “Risk Factors” and the section titled “Summary of Risks Affecting our Business” in IAA’s most recent Annual Report on Form 10-K for the fiscal year ended January 1, 2023.

The forward-looking statements included in this communication are made only as of the date hereof. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Many of these risk factors are outside of our control, and as such, they involve risks which are not currently known that could cause actual results to differ materially from those discussed or implied herein. RBA does not undertake any obligation to update any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by law.

REFERENCES:

https://www.conference-board.org/blog/labor-markets/employment-dec-2022

https://publish.manheim.com/en/services/consulting/used-vehicle-value-index

https://publish.manheim.com/en/services/consulting/used-vehicle-value-index

https://matthey.com/products-and-markets/pgms-and-circularity/pgm-management

https://capital.com/palladium-price-forecast-and-market-outlook

https://capital.com/palladium-price-forecast-and-market-outlook

https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-lithium.pdf

Based on or derived from IAA’s own internal data.

https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate

https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate

https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate

https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate

https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate

https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate

https://www.thebalancemoney.com/what-is-the-ideal-gdp-growth-rate

https://www.thebalancemoney.com/what-is-the-ideal-gdp-growth-rate

https://www.forbes.com/advisor/investing/fed-funds-rate-history

https://www.conference-board.org/blog/labor-markets/employment-dec-2022

https://www.conference-board.org/blog/labor-markets/employment-dec-2022

https://www.hiringlab.org/2022/12/08/growth-in-us-posted-wages-is-strong-but-slowing

https://www.cnbc.com/2023/01/06/2022-us-auto-sales-are-worst-in-more-than-a-decade

https://www.cnbc.com/2023/01/06/2022-us-auto-sales-are-worst-in-more-than-a-decade

https://www.consumerreports.org/buying-a-car/global-chip-shortage-makes-it-tough-to-buy-certain-cars

https://www.consumerreports.org/buying-a-car/global-chip-shortage-makes-it-tough-to-buy-certain-cars

https://publish.manheim.com/en/services/consulting/used-vehicle-value

https://publish.manheim.com/en/services/consulting/used-vehicle-value

https://www.cnn.com/2023/01/16/business/used-car-prices/index

Based on or derived from IAA’s own internal data

https://federalmetals.ca/the-benefits-of-recycling-vs-extracting-raw-metal

https://agmetalminer.com/2022/12/27/steel-prices-yearly-review

https://agmetalminer.com/2022/12/29/aluminum-prices-and-global-market-a-2022-review

https://agmetalminer.com/2022/12/29/aluminum-prices-and-global-market-a-2022-review

https://agmetalminer.com/2022/12/29/aluminum-prices-and-global-market-a-2022-review

https://agmetalminer.com/2022/12/29/aluminum-prices-and-global-market-a-2022-review

https://matthey.com/products-and-markets/pgms-and-circularity/pgm-management

https://capital.com/palladium-price-forecast-and-market-outlook

https://insideevs.com/news/631980/us-ev-market-share-increased-2022

https://insideevs.com/news/631980/us-ev-market-share-increased-2022

https://electrek.co/2022/11/29/tesla-owns-us-ev-market-but-losing-market-shares-data

https://electrek.co/2022/11/29/tesla-owns-us-ev-market-but-losing-market-shares-data

https://www.cbsnews.com/news/u-s-economy-international-monetary-fund-60-minutes-2023-02-05

https://www.cbsnews.com/news/u-s-economy-international-monetary-fund-60-minutes-2023-02-05

https://www.cbsnews.com/news/u-s-economy-international-monetary-fund-60-minutes-2023-02-05

https://www.cbsnews.com/news/u-s-economy-international-monetary-fund-60-minutes-2023-02-05

https://www.cnbc.com/2022/10/06/growing-share-of-car-buyers-pays-1000-or-more-a-month-for-loans.html

https://www.consumerreports.org/buying-a-car/global-chip-shortage-makes-it-tough-to-buy-certain-cars

https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-lithium.pdf

https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-lithium.pdf

https://agmetalminer.com/2022/12/27/steel-prices-yearly-review

https://agmetalminer.com/2022/12/29/aluminum-prices-and-global-market-a-2022-review

Based on or derived from IAA’s own internal data

https://www.bankofcanada.ca/2023/01/fad-press-release-2023-01-25

https://www.bankofcanada.ca/2023/01/fad-press-release-2023-01-25

https://www.statista.com/statistics/1293131/canada-daily-average-gas-prices

https://www.bdc.ca/en/articles-tools/blog/2023-economic-outlook-cause-caution-not-alarm

https://www.bdc.ca/en/articles-tools/blog/2023-economic-outlook-cause-caution-not-alarm

https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/publications/monthly-economic-letter/2212

https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/publications/monthly-economic-letter/2212

https://www.pwc.co.uk/economic-services/ukeo/ukeo-april-2022.pdf

https://www.pwc.co.uk/economic-services/ukeo/ukeo-april-2022.pdf

https://www.rateinflation.com/inflation-rate/uk-inflation-rate/

https://www.pbs.org/newshour/politics/why-uk-energy-bills-are-skyrocketing

https://www.pwc.co.uk/economic-services/ukeo/ukeo-april-2022.pdf

https://www.pwc.co.uk/economic-services/ukeo/ukeo-april-2022.pdf

https://www.cnn.com/2022/12/05/economy/uk-economy-lost-decade-cbi/index.html

https://www.cnn.com/2022/12/05/economy/uk-economy-lost-decade-cbi/index.html

https://www.cnn.com/2022/12/05/economy/uk-economy-lost-decade-cbi/index.html

https://www.cnn.com/2022/12/05/economy/uk-economy-lost-decade-cbi/index.html